Get the free vanguard beneficiary form

Show details

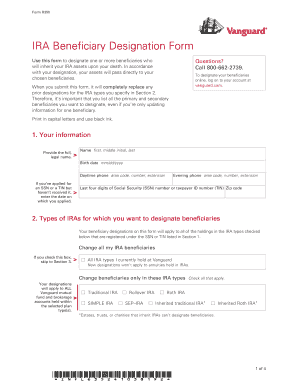

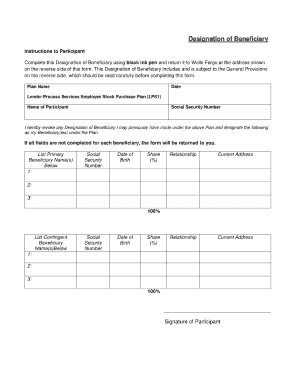

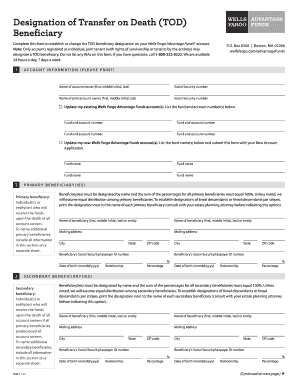

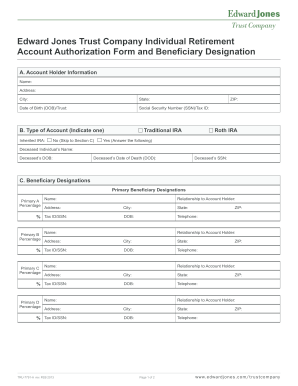

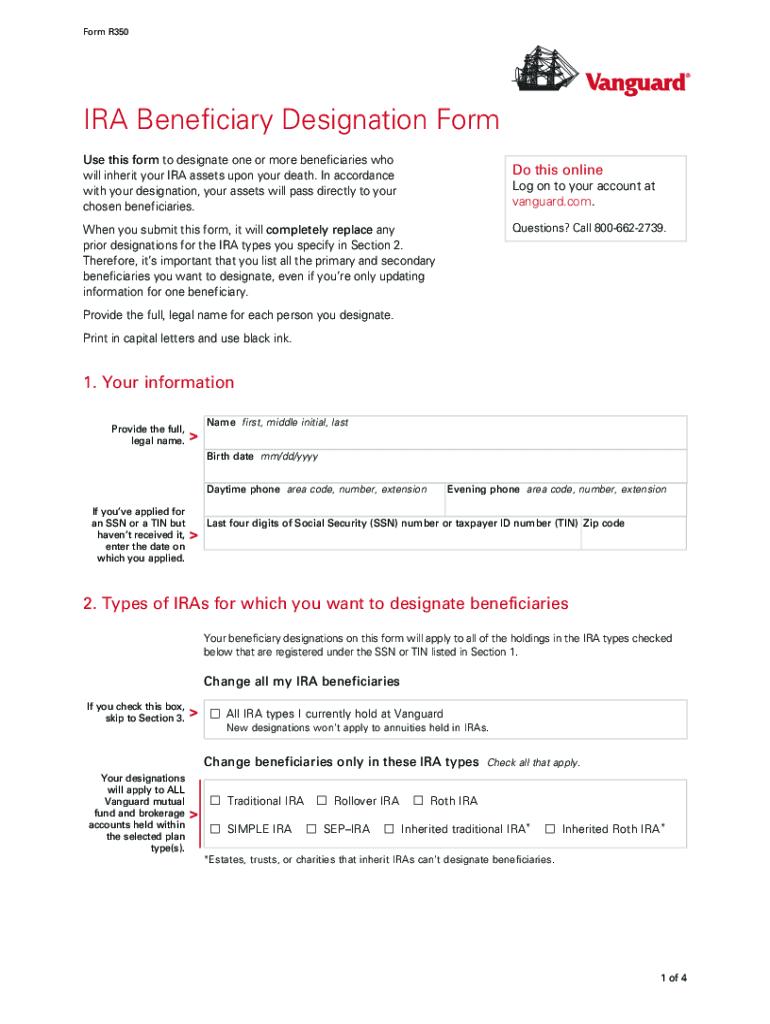

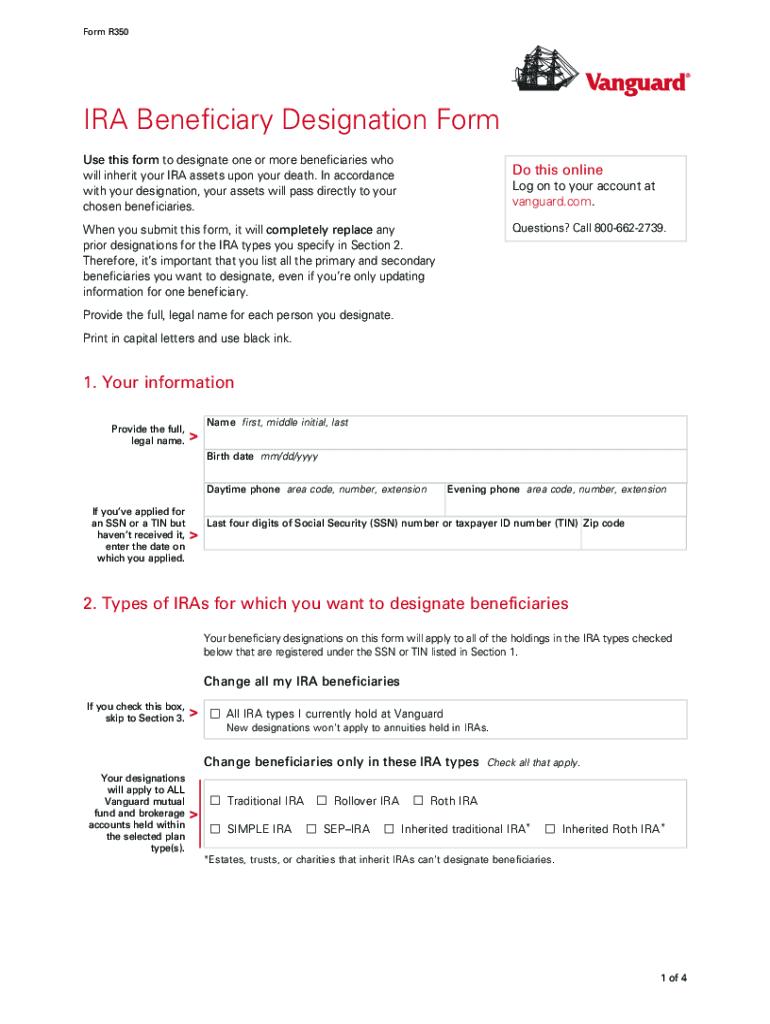

Designating beneficiaries is an important part of your estate plan because it gives you control over who will receive your assets after your death. It also can help transition your assets with less cost and delay. To designate your beneficiaries by mail Complete the enclosed IRA Beneficiary Designation Form then mail it to us in the postage-paid envelope provided. You ll receive a confirmation by mail once your beneficiary designations have been ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign how to fill out vanguard beneficiary form pdf 11

Edit your vanguard beneficiary designation form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vanguard ira beneficiary designation form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing vanguard change of beneficiary form online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit vanguard beneficiary forms download. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accessing the vanguard beneficiary form and editing the form easily

How to fill out Vanguard beneficiary form PDF:

01

Download the Vanguard beneficiary form PDF from the official Vanguard website.

02

Open the form using a PDF reader software on your computer.

03

Start by entering your personal information, such as your full name, address, and contact details, in the designated fields.

04

Provide your Social Security number or Vanguard account number, whichever is applicable.

05

Select the type of account for which you are designating a beneficiary, such as an individual retirement account (IRA) or a brokerage account.

06

Enter the full name, relationship, and contact information of the primary beneficiary in the appropriate fields.

07

If you want to designate multiple primary beneficiaries or contingent beneficiaries, follow the instructions on the form to provide their information.

08

Specify the percentage or fraction of the account assets each primary beneficiary should receive.

09

Indicate whether you want the assets to be divided equally among the primary beneficiaries or in the specified percentages.

10

If you have any special instructions or preferences regarding the distribution of your assets, include them in the designated section.

11

Sign and date the form at the bottom to indicate your consent and understanding of the information provided.

12

Make a copy of the completed form for your records before sending it to Vanguard using the contact information provided on the form.

Who needs Vanguard beneficiary form PDF:

01

Individuals who have a Vanguard account, such as an IRA or a brokerage account.

02

Those who want to designate one or more beneficiaries to inherit their Vanguard account assets upon their death.

03

Vanguard account holders who want to ensure the proper distribution of their assets according to their wishes in the event of their demise.

Fill

vanguard ira beneficiary form

: Try Risk Free

People Also Ask about vanguard beneficiary claim

Can I name a beneficiary on my Vanguard account?

The short answer: Anyone can be a beneficiary on your IRA, including minor children. And your beneficiaries don't need to be family members. It's important that the beneficiaries listed on your Vanguard accounts match your beneficiaries' legal names when they inherit the accounts, so don't use nicknames.

How do I add beneficiaries to my Vanguard account?

How do I add a beneficiary? Select Profile & Account Settings from the main navigation. On the Beneficiaries page, choose the account (for non-retirement) or account grouping (for retirement) you'd like to designate beneficiaries for. Choose your desired Allocation, then select Continue.

How do I get a letter of acceptance from Vanguard?

Many times, the company holding your employer plan will require an LOA from Vanguard. An LOA is just a letter that says Vanguard will receive the assets. They'll need this because they want to know where to send your funds. You can generate an LOA from Vanguard by going through our online rollover process.

How do I get Vanguard paper forms?

To request a Prospectus for a Non Vanguard Mutual Fund or ETF by mail, please contact us at 1-800-VANGUARD.

Does Vanguard send paper statements?

You have the right to request and obtain, free of charge, a paper version of your account statements. You can print it right off Vanguard's website, or contact Vanguard at 800•523•1188 to request that one be mailed. You can also get Vanguard statements by mail automatically.

What documents do I need to open a Vanguard account?

To open an account, you'll need this personal information: Your bank account and routing numbers. Your Social Security number. Your employer's name and address.

How do I withdraw money from my Vanguard retirement account?

How do I make a withdrawal? Log into your account. Select 'Payments' from the 'My Portfolio' menu. Select 'Money out' Any money held as cash and available for withdrawal will be shown here. Select 'Withdraw cash' Follow the on-screen instructions.

How do I add a beneficiary to my brokerage account?

You should contact your financial institution or brokerage institution to designate a beneficiary. You will usually be asked for the person's full legal name and their relationship to you. You may also need to provide a mailing address, phone number, Social Security number and date of birth.

What to do when an account holder dies Vanguard?

Call us at 800-662-2739. The Transfer on Death Plan is a straightforward way to designate beneficiaries for certain Vanguard nonretirement mutual fund and/or brokerage accounts.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute vanguard beneficiary change form online?

pdfFiller has made it easy to fill out and sign vanguard forms download. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I complete vanguard transfer on death form on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your how to add beneficiary to vanguard account from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Can I edit vanguard name change form on an Android device?

With the pdfFiller Android app, you can edit, sign, and share vanguard forms pdf on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is vanguard beneficiary form pdf?

The Vanguard beneficiary form PDF is a document used to designate beneficiaries for accounts held at Vanguard, specifying who will receive the assets upon the account holder's death.

Who is required to file vanguard beneficiary form pdf?

Account holders at Vanguard who wish to designate beneficiaries for their accounts are required to file the Vanguard beneficiary form PDF.

How to fill out vanguard beneficiary form pdf?

To fill out the Vanguard beneficiary form PDF, the account holder needs to provide their personal information, list the beneficiaries' names, relationships, and percentages of assets, and then sign and date the form.

What is the purpose of vanguard beneficiary form pdf?

The purpose of the Vanguard beneficiary form PDF is to ensure that assets in the account are transferred to the designated beneficiaries efficiently and according to the account holder's wishes after their death.

What information must be reported on vanguard beneficiary form pdf?

The information that must be reported on the Vanguard beneficiary form PDF includes the account holder's name, account number, beneficiaries' names, their relationships to the account holder, and the percentage of assets each beneficiary is to receive.

Fill out your vanguard beneficiary form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

You Should Contact Your Financial Fund And Or Brokerage Accounts is not the form you're looking for?Search for another form here.

Keywords relevant to vanguard beneficiary claim form

Related to the vanguard beneficiary form is essential for allows account holders to designate individuals or

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.